Struggle for Hindu Existence

*Hindu Rights to Survive with Dignity & Sovereignty *Join Hindu Freedom Movement to make Bharat Hindu Rashtra within this lifetime *Jai Shri Ram *Jayatu Jayatu Hindu Rashtram *Editor: Upananda Brahmachari.

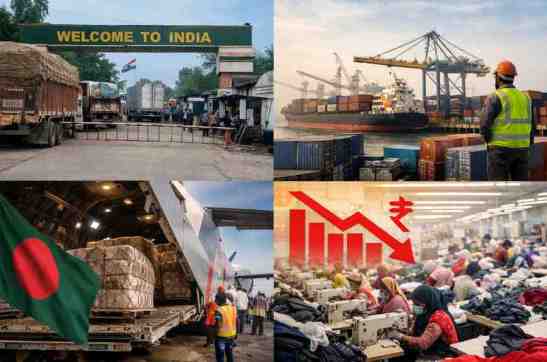

From Massacres to Market Pressure: How India Can Trigger Economic Shockwaves to Halt Persecution of Hindus in Bangladesh.

Economic Shockwaves for Bangladesh if India Shuts Land Routes, Sea Routes, and Airspace.

Bangladesh’s Hindus Face New Persecution, From Massacres to Calculated Erasure🔗. Here, writer Animitra Chakroborti analyzes Indo-Bangladesh trade relations, arguing that India can leverage economic pressure to create decisive shockwaves and take control of the situation in a definitive manner.

ßangladesh’s economy is deeply interlinked with India through geography, history, and trade. India is Bangladesh’s largest regional trading partner and one of its most critical connectivity gateways. In the 2024–25 financial year, bilateral trade crossed approximately USD 13.5 billion, with Bangladesh importing goods worth over USD 11 billion from India and exporting slightly above USD 2 billion in return. Beyond trade value, India’s importance lies in its role as Bangladesh’s most accessible transit partner for land, sea, and air connectivity. If India were to close its land routes, sea routes, and airspace to Bangladesh, the financial consequences for the Bangladeshi economy, precisely economic shockwaves would be severe, immediate, and long-lasting.

Bangladesh’s trade structure makes it particularly vulnerable to disruptions with India. The country depends heavily on cross-border land routes for fast and cost-effective movement of goods. More than three-quarters of Bangladesh’s exports to India, especially ready-made garments, plastics, processed food, and light engineering products, have historically moved through land ports such as Benapole, Bhomra, Akhaura, and Darshana. These routes allow deliveries within days at relatively low cost. A complete closure would abruptly cut off this advantage, economic shockwaves would compel exporters to seek slower and more expensive alternatives or abandon the Indian market altogether.

The immediate financial impact would be felt through lost export earnings. Bangladesh exports between USD 1.5 and 2 billion worth of goods annually to India. Even partial restrictions imposed by India in recent years affected nearly USD 770 million worth of Bangladeshi exports, around 42 percent of total bilateral imports from Bangladesh. A total shutdown of land, sea, and air access would likely wipe out a substantial portion of this export revenue. For small and medium exporters who rely almost entirely on the Indian market due to proximity and lower compliance costs, economic shockwaves could result in factory closures, contract cancellations, and widespread business failures.

Logistics costs would rise sharply as trade is rerouted through longer maritime paths. Land transport between Bangladesh and India is typically 20 to 30 percent cheaper than sea freight for regional trade. When land routes are closed, Bangladeshi exporters are forced to ship goods from Chattogram or Mongla ports, often via transshipment hubs like Colombo or Singapore, before reaching Indian ports. What once took one or two days by road can stretch into two to four weeks by sea. These delays increase freight charges, insurance costs, warehousing expenses, and working capital requirements, eroding already thin profit margins and reducing competitiveness.

The closure of sea routes would further amplify these losses. Bangladesh’s seaports are the backbone of its export economy, handling over three million TEUs of cargo annually, with ready-made garments accounting for the bulk of outbound shipments. Denial of sea access to India would disrupt not only bilateral trade but also transshipment efficiencies and coastal shipping arrangements that have developed in recent years. Thanks to economic shockwaves industries such as jute, leather, ceramics, frozen food, and pharmaceuticals, which rely on predictable maritime logistics, would face cancelled orders and declining global confidence in Bangladesh as a reliable supplier.

Airspace closure would create an additional layer of economic stress. While air cargo volumes are smaller compared to sea freight, they carry high-value and time-sensitive goods such as apparel samples, pharmaceuticals, electronics components, and perishables. Bangladesh handled nearly 285,000 tonnes of air cargo in recent years, much of it tied to fast fashion supply chains and urgent export commitments. If Indian airspace were closed, flights would be forced to take longer routes, raising fuel costs, reducing cargo capacity, and increasing freight rates. For exporters dependent on rapid delivery, this could mean missed deadlines and lost buyers.

Imports would also be severely affected, creating inflationary pressure across the economy. Bangladesh imports nearly USD 9 to 11 billion worth of goods annually from India, including cotton yarn, raw cotton, machinery, spare parts, chemicals, petroleum products, food grains, onions, sugar, and medicines. Disruption of these supply lines would push manufacturers to source inputs from more distant and expensive markets, raising production costs. In the short term, economic shockwaves would lead to shortages of essential commodities could drive up consumer prices, aggravating inflation and hitting lower-income households hardest.

The ready-made garment sector, the backbone of Bangladesh’s economy, would face indirect but serious damage for economic shockwaves. Although most garment exports go to Europe and North America, the industry depends on Indian raw materials and land connectivity for cost efficiency. Bangladesh’s garment exports were valued at around USD 38 to 40 billion in recent years and employ over four million workers. Any sustained increase in logistics costs or disruption in raw material supply would weaken Bangladesh’s competitive edge against rivals such as Vietnam, Cambodia, and Ethiopia, potentially leading to reduced orders and job losses.

Macroeconomic stability would also come under strain. Trade disruptions would reduce foreign exchange inflows from exports while increasing the cost of imports, worsening the current account balance. Bangladesh’s trade openness, with exports and imports together accounting for more than a quarter of GDP, means that prolonged trade shocks can directly slow economic growth. Economic shockwaves resulting in Reduced dollar inflows would put pressure on foreign exchange reserves and weaken the Bangladeshi taka, further increasing import costs and inflation.

Employment losses would likely spread beyond exporters to logistics, transport, warehousing, and port services. Border regions and industrial clusters that depend on cross-border trade would be particularly vulnerable. The government might be forced to increase subsidies, offer stimulus packages, or expand social safety nets, placing additional pressure on public finances at a time when fiscal space is already limited.

In the longer term, repeated or prolonged closures would damage investor confidence. Foreign and domestic investors value predictability in trade and logistics. If India-Bangladesh connectivity becomes unreliable, multinational companies may reconsider investment or expansion plans in Bangladesh, especially in export-oriented manufacturing. Although Bangladesh could attempt to diversify trade routes and partners, such structural adjustments require time, infrastructure investment, and policy coordination, and cannot fully replace the geographic advantage India provides.

Ultimately, economic shockwaves for the financial consequences of India closing land routes, sea routes, and airspace to Bangladesh would extend far beyond bilateral trade figures. It would disrupt supply chains worth billions of dollars, raise costs across the economy, fuel inflation, threaten employment, and slow economic growth. Even limited restrictions in recent years have demonstrated how sensitive Bangladesh’s economy is to changes in connectivity with India. A complete shutdown would represent one of the most serious external economic shocks Bangladesh could face, underscoring how deeply intertwined the two economies are and how vital open transport links remain for Bangladesh’s financial stability and future development.

A prolonged and comprehensive closure of India’s land routes, sea routes, and airspace could significantly push Bangladesh toward higher debt risk and potentially a debt crisis,

..

Writer Shri Animita Chakraborty is a journalist and columnist, and an active member of Bengal Volunteers.

Writer Shri Animita Chakraborty is a journalist and columnist, and an active member of Bengal Volunteers.

This Article was first published in Kanjik Net on January 8, 2026.

pls stop giving attention to this gentleman. He is not a Shankaracharya. He is a politically motivated person . He…

[…] Death threats from India, Pakistan, UAE, and across Middle East […]

Wholeheartedly support the protest movement of saints

Good morning sir I was with you people in Yatra How are you sir Navy Doctor My number 8800536141

how funny. They live on Hindus paid taxes money and act against Hindu interest. Their funds from Tax money should…